How to Read Your Pay Stub

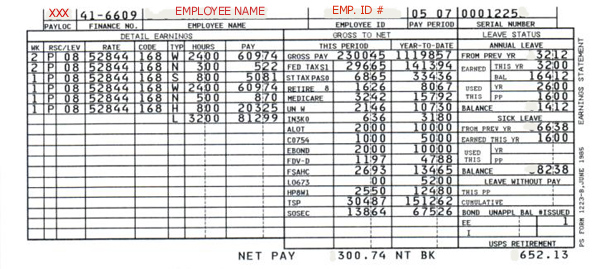

"Form 1223"

The information we've prepared for you is reliable, but not fail-safe or guaranteed. This page is meant to be a quick reference/guideline for most of the more common codes. No attempt has been made to explain ALL the codes, just the ones most members will see. Keep in mind that the USPS makes periodic changes to the Form 1223, as you might have noticed with the arrival of the new employee ID number as of PP14-03.

For absolute and guaranteed information about your paystub, or if you find a code on your stub that is not mentioned here, please call Human Resources for an exact explanation.

Going from left to right, and from the top of your stub to the bottom of it:

PAYLOC

Your pay location code indicates where you are assigned to work, sometimes the last two digits of your work location ZIP Code.

FINANCE NO

Finance number for the facility that you work in.

EMPLOYEE NAME

Your name.

EMPLOYEE ID

Your 8-digit employee ID number, instituted in pay period 14 of 2003, replaces the employee Social Security number previously used, to help strengthen privacy concerns.

PAY PERIOD

This is the pay period and year in which you receive the payments (PP-YR or 01-00). Each calendar year is separated by twenty six (26) pay periods of two (2) weeks each.

SERIAL NUMBER

This is either the serial number of the check issued to the employee or the sequence number of the "Form 1223" earnings issued when the employee's net pay has been directly deposited to the financial institution of their choice.

DETAIL EARNINGS

This is the general heading for all of the columns which identify the type and number of hours you are being compensated for, the week in which those hours occurred, the rate schedule and level, the designation/activity code, and the gross payment amount for the period.

- WK --This specifies the week, either 1 or 2, of the pay period in which the hours were worked. If an adjustment is being made, the week that the adjustment is made for will be printed on that line.

- RSC --This is the Rate Schedule Code for the hours stated. This code will be the same as on your time card.

- LEV --This is the Grade Level for the hours stated.

- RATE --This the Base rate (annual or hourly), including the cost-of-living allowance (COLA) for the hours stated.

- CODE --This is the employee's Designation/Activity code. For clerks, the code would be 110.

- TYP --This is the Type of Hours code. Codes include:

- G -- Guaranteed time or guaranteed overtime hours

- H -- Holiday work hours

- L -- Leave hours (either paid leave or leave without pay)

- N -- Night differential hours (for hours worked between 6:00 PM & 6:00 AM)

- O -- Overtime hours

- V -- Penalty overtime hours

- P -- Out-of-Schedule Premium

- S -- Sunday Premium

- W -- Straight work hours

- HOURS --This space will show the actual hours and hundredths worked for every hours type listed.

- PAY --This space will show the total gross pay for each type of hours worked.

GROSS TO NET

This is the general heading for the two columns which show the total gross pay, all deductions, and the resulting net pay for the current pay period and the pay year-to-date.

- GROSS PAY --This is the gross pay for this pay period and the year-to-date, including COLA.

- FED TAX --This is the amount deducted for federal tax this period and year-to-date. Your claimed marital status and number of exemptions will appear next to FED TAX. M2 would mean married with two exemptions. S0 would mean single with no exemptions.

- ST TAX --This is the amount deducted for state tax this period and year-to-date. Again, your claimed marital status and number of exemptions for the state will appear next to ST TAX. PAO1 would indicate the taxes were withheld to the State of Pennsylvania for a person married claiming one exemption.

- RETIRE --This is the amount deducted toward your retirement account for the pay period and the year-to-date.

- FICA/MED --This is the amount of FICA or Medicare deductions for this period and year-to date. If you were hired after 1984, your retirement contribution will be smaller and FICA/MED will be higher.

- UN W --Union Dues.

- IN --Indicates your life insurance choice.

- ALOT --Indicates an authorized payroll deduction from your salary that is deducted each pay period for deposit to a financial institution-- for example, a set amount directed toward a savings account.

- C SUP or CS/SS --This indicates child support or alimony payments.

- GARN --This appears if you have a commercial garnishment levied against you.

- HP --Followed by three (3) letters or numbers would show your health benefit plan enrollment code.

- LEVY --Show a deduction has been made for some sort of outstanding taxes.

- TSP --This indicates a withholding for the Thrift Savings Plan. If you participate in the plan, you will see either the percentage of withholdings or the dollar amount after the letter code.

- NET PAY --This is what is left when all is said and done. Enjoy it!

LEAVE STATUS

This is the general heading identifying your usage and balance of Annual and Sick leave, and Leave Without Pay for the pay period and year.

ANNUAL LEAVE

- FROM PREV YR --This is the number of hours carried over from the previous year.

- EARNED-THIS YR --This is the number of hours earned to date this leave year.

- EARNED-BAL --This is the number of hours carried over from last year plus the hours earned this year.

- USED THIS YR --This is the total hours of annual leave used this year to date.

- USED THIS PP --This is the total hours of annual leave used in this pay period (including adjustments).

- BALANCE --This is the total annual leave available to you now.

SICK LEAVE

- FROM PREV YR --This is the number of hours carried over from last year.

- EARNED THIS YR --This is the number of hours of sick leave accumulated this year.

- USED THIS YR --This is the total sick leave used to date this year.

- USED THIS PP --This is the total sick leave used this pay period (including adjustments).

- BALANCE --This is the total sick leave available to you now.

LEAVE WITHOUT PAY

- THIS PP --This is the total hours of LWOP used this pay period.

- CUMULATIVE --This is the total LWOP hours accumulated this year. If you accumulate eighty (80) hours of LWOP within a year, your leave credits will be reduced by the amount of leave earned in one (1) pay period.

This is the total amount contributed to the retirement fund as of the close of the prior calendar year.

Other important codes are:

FLSA

The Fair Labor Standards Act is a Federal Statute of general application that establishes requirements for child labor, minimum wages, equal pay, and overtime pay. FLSA work hours and FLSA overtime pay is printed on the Form 1223 whenever work hours for one or both weeks of the pay period exceeds forty (40) hours for nonexempt employees.

ADJ FOR PP-YR PROCESSED

Shows that an adjustment for a specific pay period and year was processed.

GARNISHMENT PAYMENTS COMPL

Shows the garnishment balance as zero (0).

GRIEVANCE OR EEO SETTLEMENT

Self Explanatory

INCLUDES BOND REFUND

Self Explanatory

MULTI PP ADJS PROCESSED

Shows that adjustments for multiple pay periods were processed.

PERIODIC STEP INCREASE

Self Explanatory

RETROACTIVE PAYMENT

Shows this is a special check and Form 1223 for retroactive payment.

RETRO PAY IN YTD AMTS

Shows that retroactive payment amounts have been added to the year-to-date totals.

SCHEDULED COLA INCREASE

Shows that a cost-of-living increase has been added to the base salary effective with the pay period shown at the top of your stub.

SCHEDULED CONTRACTUAL INCREASE

Shows that it is now reflected in the base salary.

UPDT YTD BAL CANCEL CHK

An adjustment for a cancelled check was processed that updated the year-to-date earnings balance, affecting only the year-to-date fields.

UPDT YTD BK PAY AWD

An adjustment for a back pay award was processed, affecting only the year-to-date fields.